ALESSANDRO SALVATO

Computer Engineer

TRADING STRATEGIES

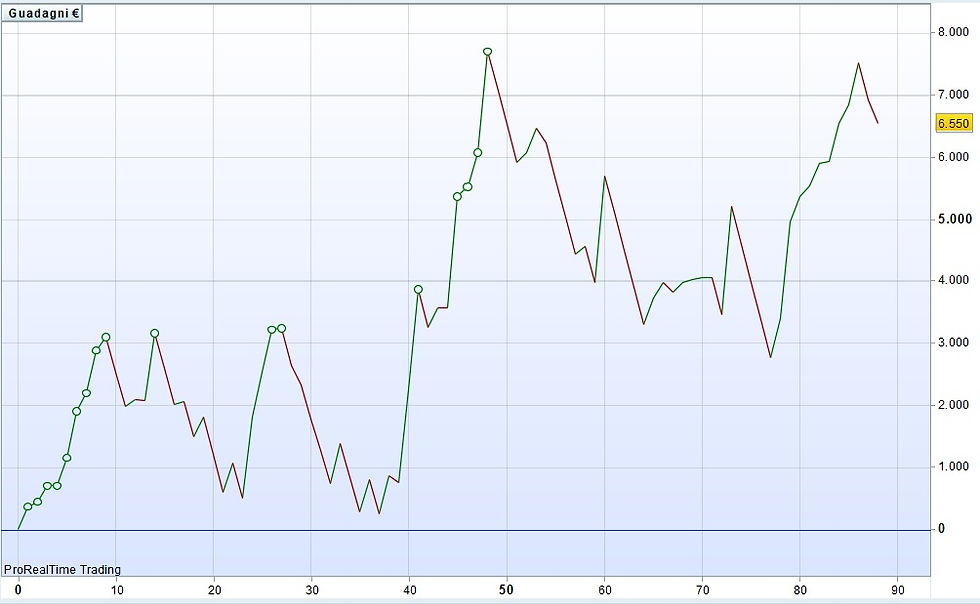

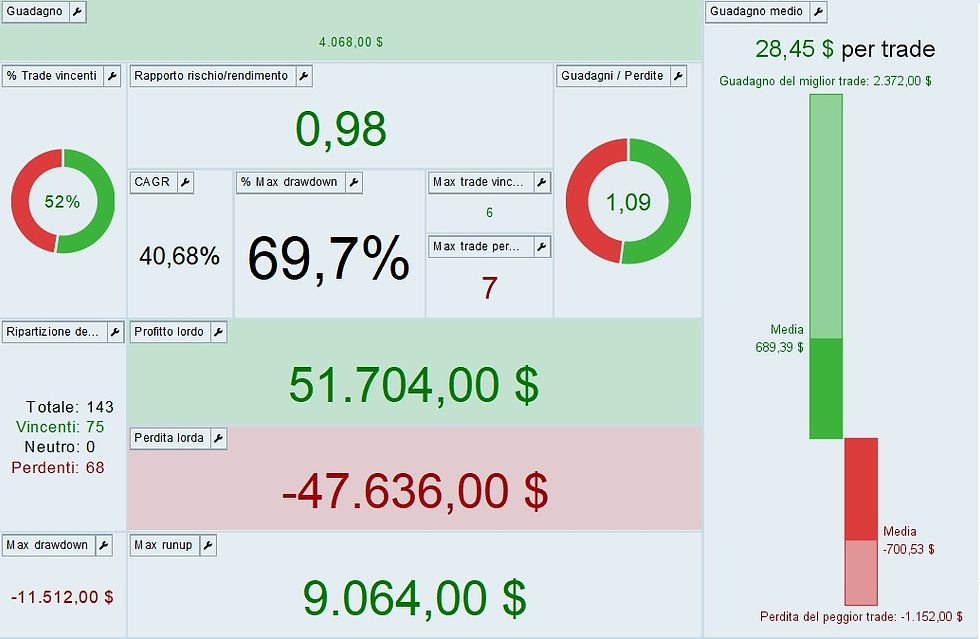

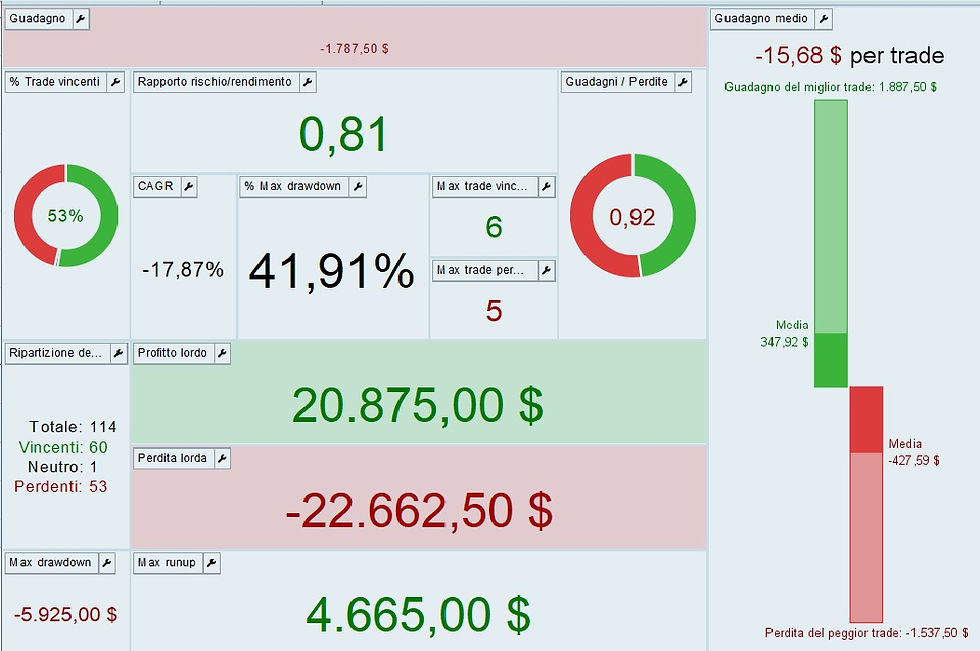

I design and manage systematic trading algorithms across major futures markets, including equity indices, commodities, currencies, and precious metals. Each system leverages volatility-based analysis to dynamically select the most appropriate strategy depending on current market conditions.

The algorithms are multi-strategy and multi-directional: they implement breakout and mean-reversion techniques, and operate both long and short. My role is to oversee this portfolio of “digital traders” using a rotational management framework: underperforming algorithms are deactivated while those demonstrating robust results in backtesting and simulation are prioritized.

Risk management is integrated at multiple levels, including position sizing, drawdown control, and exposure limits, ensuring that the overall system remains resilient under varying market conditions. This methodology allows for adaptive, data-driven trading that mimics the decision-making of experienced human traders while maintaining the speed and consistency of algorithmic execution.

Prop Firm Challenges

Look at my certifications

STOCK INDEX

Mini Dax

Micro E-mini SP500 Full Strategy

Micro E-mini Nasdaq Breakout T2 E-mini Dow Jones V Breakout 2.230 E-mini Russel 2000 Full Strategy

Mini Dax (1 ctr)

Mini Dax

Micro E-mini SP500 (5 ctr)

Micro E-mini SP500

Micro E-mini Nasdaq (3 ctr)

Micro E-mini Nasdaq

E-mini Dow Jones (1 ctr)

E-mini Dow Jones

E-mini Russel 200 (1 ctr)

E-mini Russel 2000

METALS

Micro Gold

(4 ctr)

Micro Gold

Platinum (2 ctr)

Platinum

Micro Gold Full Strategy T

Platinum Breakout & Filters

EXCHANGE

EurUsd (2 ctr)

EurUsd

ChfUsd (2 ctr)

ChfUsd

EuroUsd Breakout 3

ChfUsd Breakout 2

ENERGY

Natural Gas (1 ctr)

Natural Gas

Natural Gas Full Strategy T