Sharpe Is About Discipline

- Alessandro Salvato

- 1 feb

- Tempo di lettura: 4 min

What the Sharpe Ratio Really Measures in Trading Systems

In systematic trading, the Sharpe ratio is everywhere.

It appears in backtests, performance reports, strategy comparisons, and investment decks. It is often treated as a final verdict: higher is better, lower is worse.

That interpretation is dangerously incomplete.

The Sharpe ratio does not measure how much money a strategy makes.

It measures the quality of its returns — and, more importantly, the discipline required to generate them.

This article explains what the Sharpe ratio really measures, how its mathematical formula works, why it is often misused in trading systems, and how I evaluate it using real MES (Micro E-mini S&P 500) results, reinforced by Monte Carlo analysis.

Why the Sharpe Ratio Became So Popular

The Sharpe ratio became popular because it compresses a complex reality into a single number:

return

risk

time

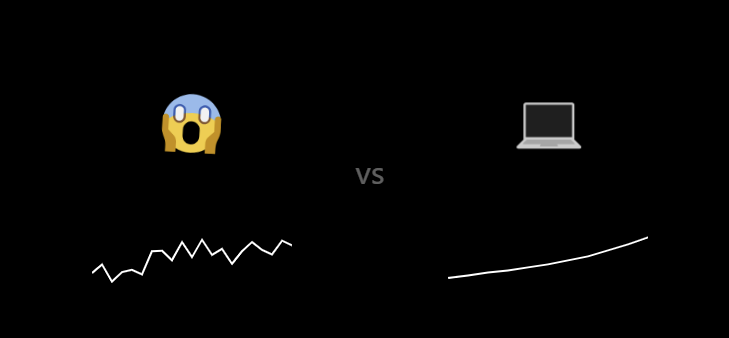

Two strategies can produce the same net profit.

Only the Sharpe ratio tells you whether one achieved it smoothly and the other by surviving repeated volatility, stress, and drawdowns.

In short:

Sharpe does not reward aggressiveness. It rewards consistency.

What the Sharpe Ratio Actually Measures

Conceptually, the Sharpe ratio answers one question:

How much excess return am I earning for each unit of risk I take?

In this context, “risk” is defined as variability of returns, not drawdown, not leverage, not emotional pain — simply volatility.

This already highlights a critical limitation:

Sharpe measures how noisy returns are, not how dangerous they are.

The Sharpe Ratio Formula (Explained Clearly)

The mathematical definition of the Sharpe ratio is:

Where:

E[R] = expected (average) return

Rf = risk-free rate

σR= standard deviation of returns

In most systematic trading applications, the risk-free rate is assumed to be zero.The formula then simplifies to:

How to Read This Formula Intuitively

The numerator rewards profitability

The denominator penalizes instability

A strategy can improve its Sharpe by:

Increasing its average return

Reducing the variability of its returns

That is why a system with lower profits but smoother execution can score a higher Sharpe than a more profitable but erratic one.

Key takeaway:

Sharpe does not care how big your wins are. It cares how irregular your path is.

The Hidden Engine: Standard Deviation of Returns

To understand Sharpe, you must understand its denominator.

Standard deviation measures how far individual returns deviate from their average.It does not measure drawdowns and does not distinguish between good and bad volatility.

The Mathematical Formula for Standard Deviation

Given a sequence of returns R1,R2,…,RN, standard deviation is defined as:

Where:

Ri = return of the i-th trade (or period)

Rˉ = average return

N = number of observations

Interpretation

Each return is compared to the average

Deviations are squared so positive and negative values count equally

Deviations are averaged

The square root restores the original unit

The result is a measure of return dispersion, not danger.

Crucially:

Standard deviation penalizes upside and downside volatility in exactly the same way.

This is a fundamental limitation of the Sharpe ratio.

A Real MES Case Study (No Hypothetical Numbers)

Let’s move from theory to real data.

The following results come from a 1-hour MES trading strategy (“SP Full Strategy”), evaluated on a statistically meaningful trade sample.

Per-trade statistics:

Average profit per trade: ≈ $296

Standard deviation per trade: ≈ $884

Risk-free rate: 0

After proper scaling, the resulting Sharpe ratio is approximately:

Sharpe ≈ 2.06

This is not a curve-fitted number.

It is computed directly from raw trade outcomes.

Why This Sharpe Is Interesting — and Still Not Enough

A Sharpe above 2 is often labeled as excellent.

But labels are meaningless without context.

In this case:

The edge is statistically positive

Losses are frequent but controlled

Volatility is real and unavoidable

The system relies on repetition, not prediction

This Sharpe tells me something precise:

The system’s edge does not come from avoiding losses. It comes from absorbing them efficiently over time.

Why Sharpe Alone Is Dangerous in Trading Systems

The Sharpe ratio relies on assumptions that trading systems routinely violate:

Returns are assumed to be normally distributed

Volatility is treated as a proxy for risk

The time ordering of trades is ignored

A system can show an excellent Sharpe and still experience deep, clustered drawdowns.

Sharpe evaluates one historical path.

Trading unfolds across many possible paths.

Why Sharpe Is Not Enough: Monte Carlo Analysis

Monte Carlo analysis reshuffles the sequence of trades thousands of times, generating alternative but statistically valid equity curves.

Monte Carlo allows us to estimate:

worst-case drawdowns not observed historically

variability of final equity outcomes

probability of severe losses early in the system’s life

It answers the only question that matters operationally:

How bad can it realistically get, even if the edge is real?

What Monte Carlo Reveals About the MES Strategy

Applied to the MES trade distribution:

The positive expectancy survives reshuffling

Average outcomes remain favorable

Drawdown depth and duration vary significantly

This leads to a critical conclusion:

The Sharpe ratio is real, but survivability depends on position sizing and portfolio context.

Without Monte Carlo, Sharpe systematically underestimates tail risk.

The D² Trading Hierarchy of Metrics

In D² Trading, metrics are evaluated in this order:

Positive expectancy

Monte Carlo survivability

Drawdown depth and duration

Sharpe / Sortino efficiency

Portfolio interaction

Sharpe is important — but it is never the starting point.

Final Thought

The Sharpe ratio does not measure how smart you are.

It measures how disciplined your edge is.

Standard deviation explains how unstable your returns are.

Monte Carlo explains whether that instability can destroy you.

Only what survives can compound.

That is the philosophy behind D² Trading.

Commenti