On Jim Simons

- Alessandro Salvato

- 2 set 2025

- Tempo di lettura: 2 min

Most traders dream of beating the market.

Jim Simons didn’t just beat it—he solved it.

That’s literally the title of Gregory Zuckerman’s book: “The Man Who Solved the Market.”

And it’s no exaggeration.

🔹 The unlikely trader

Simons wasn’t a Wall Street wolf. He was a mathematician, a codebreaker, a professor. According to the book, he was more comfortable scribbling equations on a blackboard than talking about stock tips.

He had no finance background. But he had something better: the conviction that markets weren’t pure chaos—that there were hidden patterns waiting to be decoded.

🔹 Enter Medallion

The book describes the Medallion Fund as the closest thing to a financial black box. Outsiders don’t know the strategies. Insiders don’t talk.

What’s public is jaw-dropping:

Returns averaging 66% per year before fees for three decades.

About 39% after fees—still untouchable by any hedge fund in history.

So good they had to close the fund to outsiders. Only employees can get in now.

As Zuckerman notes, Medallion became “the most successful money-making machine in the history of modern finance.”

🔹 The secret sauce

Zuckerman highlights Simons’ genius not just in math, but in team-building. Instead of hiring Wall Street hotshots, he filled Renaissance with:

Mathematicians 🧮

Physicists 🔭

Computer scientists 💻

People who looked for signals in noise, whether in DNA sequences or cosmic data—and then applied the same logic to financial markets.

🔹 Not emotionless after all

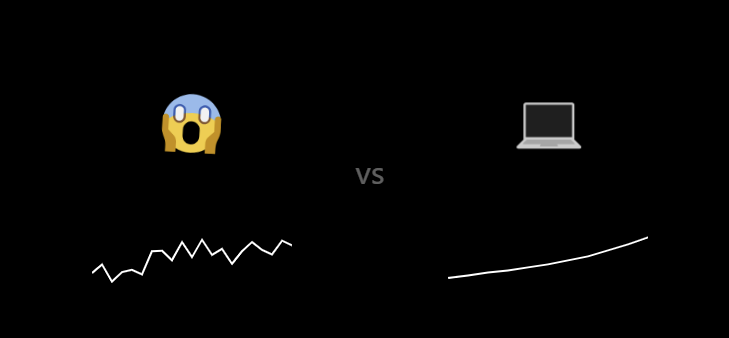

One of the book’s key themes: even Simons and his team weren’t immune to human psychology.Yes, algorithms did the trading. But people could always pull the plug. And sometimes, they did—proving that discipline and humility mattered as much as code.

🔹 The lesson

Simons’ story isn’t about a magic formula. It’s about decades of grinding, coding, testing, and trusting data over ego.

As Zuckerman puts it, Simons built a system that turned messy human markets into solvable math problems—at least for those inside Renaissance’s fortress.

The rest of us? We can only watch, learn, and try not to fool ourselves into thinking gut feelings will ever beat an equation.

Commenti