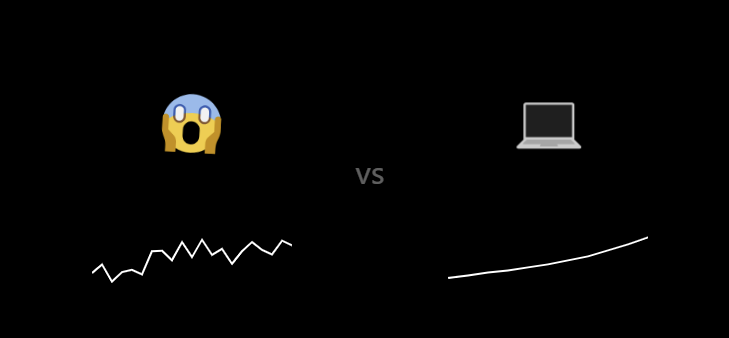

Your Emotions Suck at Trading. Algorithms Don’t

- Alessandro Salvato

- 2 set 2025

- Tempo di lettura: 2 min

Let’s be honest: your emotions are terrible at trading.

😱 Fear makes you sell too early.

🤤 Greed makes you hold too long.

🤞 Hope makes you double down on bad decisions.

That’s why most traders lose money—and sleep.

Enter the computer.

💻 Algorithms don’t feel fear. They don’t get greedy. They don’t hope. They just follow rules.

🔹 What algorithmic trading really is

Algorithmic trading (or algo trading) is nothing more than writing down a set of rules—and letting a machine execute them automatically.

Those rules say:

When to enter a trade

How to manage it (stop losses, take profits, trailing stops)

When to exit

The machine doesn’t panic. It doesn’t improvise. It just does what you told it to do.

🔹 Why it beats your gut

No emotions (in theory) → Computers don’t flinch.

Consistency → The rules are the same, every single time.

Testability → You can backtest a system on years of data.

Speed → Algorithms react in milliseconds, while you’re still “thinking it over.”

Sounds perfect, right? Well… not exactly.

🔹 The inconvenient truth 🧠

People love to repeat: “Algorithms eliminate emotions.”

That’s only half true.

Because you can always hit the stop button.And the moment you do, psychology kicks the door wide open:

😨 Exit too early because you’re scared to lose profits.

😡 Hold longer because you refuse to accept a loss.

🙃 Override the rules because “this time feels different.”

The system isn’t failing. You are.

Algo trading minimizes emotions, but it never deletes them—because the human is still in charge.

🔹 The dumbest (but most famous) example

📈 Buy when the 10-day moving average crosses above the 50-day moving average.

📉 Sell when it crosses below.

That’s it. That’s an algorithm.

Boring? Yes.

🔹 Where it rules the markets

Everywhere:

Stocks

Futures

Forex

Crypto

From billion-dollar hedge funds to nerds coding in their bedrooms—algorithms run the markets behind the scenes.

🔹 How to actually start

No, you don’t need a PhD. But you do need:

📚 Basic understanding of financial markets

💻 A platform or coding language (ProRealTime, Python, MetaTrader)

📏 Knowledge of risk metrics (drawdown, Sharpe ratio, expectancy)

🕰️ Patience to test, break, and rebuild strategies

And above all: the discipline not to sabotage your own system.

🔹 The takeaway

Your emotions suck at trading.

Algorithms don’t.

But here’s the deal: the algorithm is only as strong as your ability to let it run.

If you can’t resist pressing the stop button, all the code in the world won’t save you.

Trading is numbers, yes. But it’s also psychology.

Ignore one, and you’ll lose with the other.

Commenti